Build to Rent Australia - Market Report Q2 2025

by Peter Wargent, co-Founder

Build to Rent Australia

Market Report Q2 2025

Background in Australia

- Build-to-rent (BtR) is a model proven internationally whereby developers construct multi-unit buildings and, instead of selling the units, retain ownership and rent them out to tenants.

- The sector benefits institutional landlords, investors seeking stable long-term income streams, and tenants desiring security of tenure and longer-term leases without fear of eviction or of the landlord selling.

- While a relatively new sector in Australia, the market has already grown substantially in the US, UK, and across much of Western Europe.

BtR is a nascent sector in Australia, but is expected to grow dramatically over the next decade and beyond.

Supply and pipeline overview

There are around 13,000 BtR dwelling units under construction in Australia at the present time.

A further 20,000 units are already approved to be completed over the next five years.

Although this represents impressive growth in the sector from small beginnings, it is also only a fraction of the potential for the sector over the years and decades ahead.

Australia currently has around 11¼ million dwellings, but the BtR sector remains in its early phases and only a tiny fraction of the dwelling stock.

BtR market potential in Australia

BtR is currently only a $17 billion sector in Australia, or just 0.2% of the total value of the residential dwelling stock.¹

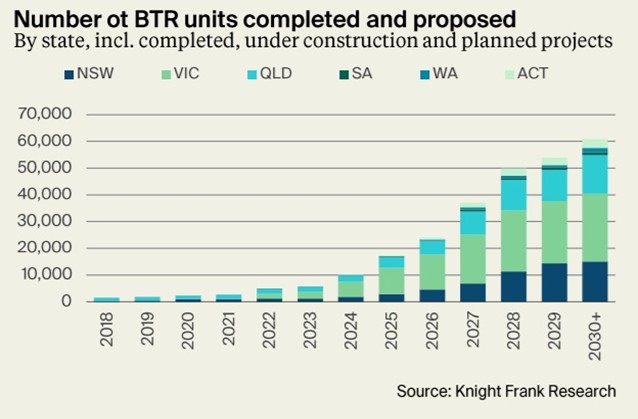

Currently, according to Knight Frank Research, planned and proposed projects show that the sector will continue to grow significantly over the remainder of this decade and beyond.

Moreover, it is believed that the sector has the potential to grow to $290 billion in value and beyond over the coming years, or ~3% of the residential market in Australia.²

For example, the UK already has 290,000 BtR units either built or in the pipeline, including 96,000 in London, and in 2024 investment volumes exceeded £5 billion for the first time.³

In the more mature US housing market, BtR already accounts for 12% of the US dwelling stock.⁴

This demonstrates the potential for the sector over the longer term in Australia, as the business model becomes more sophisticated and attractive for landlords, investors, and renters seeking security of tenure.

BtR market faced down headwinds in 2024

Housing market supply in Australia faced a perfect storm of headwinds through 2023 and 2024, with rising interest rates and steepling construction costs leading to a surge in developer insolvencies, and a general risk aversion across the residential development sector.

With risk-free rates moving significantly higher as the global economy reopened for business, the hurdle for BtR projects to pass feasibility was far more challenging in 2023 and 2024.

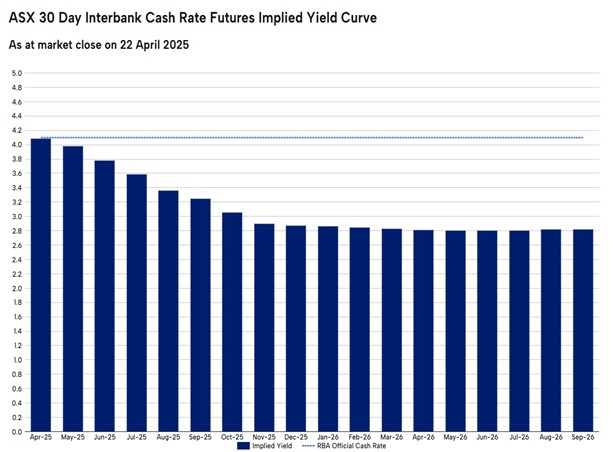

We have now moved beyond the peak of the monetary tightening cycle, with the Reserve Bank of Australia delivering the first cut in the easing cycle in February 2025, which effectively removed the 25 basis points hike of November 2023 from current policy settings towards an easier stance.

Further monetary easing is priced in for the remainder of 2025 and for early 2026, with the neutral cash rate target thought to be around 3%.

Trading conditions for developers in Australia are expected to become far more favourable through the next 18 months.

More exciting BtR projects in the pipeline

The largest existing BtR project in Australia is District Living, situated in Docklands in Melbourne.

The Docklands area represents a prime example of an inner suburban location that is ideally suited for BtR units.

Meanwhile, Investa and Oxford Properties Group have delivered 1,400 apartments across a BtR portfolio spanning Footscray in Melbourne, above the new Gadigal Metro, and in Sydney’s Central Business District.

Local developer Aqualand has lodged a development application with the New South Wales government for North Sydney’s first BtR project, set to be constructed at 146 Arthur Street, aiming to replace an existing commercial building with a 46-storey tower, set to include 390 rental apartments above a ground-floor retail and commercial precinct.

In Brisbane, a Canadian pension fund and Hines — a US-based real estate investment manager — have acquired an 89-unit BtR building in Fortitude Valley, plus an under-construction 265-unit BtR development in South Brisbane.

International funding via Sumitomo and Cedar Pacific has also supported development at 50 Quay Street in Brisbane, as part of the Queensland Treasury affordable BtR programme.

The 32-storey project includes 475 apartments overlooking the Brisbane River, with 50% of apartments delivered to be offered at below-market rents.

Outlook for Australian BtR sector

Interest rates are expected to ease through 2025 and early 2026, kicking off a new residential construction cycle.

Following the reopening of Australia’s border during the pandemic period, construction cost inflation rose dramatically to an annual rate of above 20%, but now cost inflation for materials and labour has levelled out as supply and demand have come back into balance.

With Australia facing a chronic structural undersupply of housing, all sectors of residential development are likely to thrive over the remainder of the decade, including strong growth in BtR projects.

The Australian Federal Government has also amended withholding tax legislation for the BtR sector to encourage development from international developers as well as those based locally.

Of the capital cities, Melbourne is likely to become the central focal point for BtR projects in Australia, thanks to more favourable zoning and planning rules, and comparatively more affordable land prices versus the geographically constrained city of Greater Sydney.

Approximately 50% of BtR dwelling units are forecast to be delivered in Melbourne, with Brisbane and Sydney also attracting significant BtR investment over the next decade.

References

¹ NAB News — Will 2025 be a breakthrough year for housing?

² Clayton Utz — Build-to-Rent Regulatory Change

³ Knight Frank — UK BTR Market Update

⁴ Property Council of Australia — BTR Submission